We always heard “Accounting” especially if we talk about Mathematics. Accounting is not just a Mathematical cycle, it is for making changes, improving performance and more.

- What is Accounting? It is the process of IDENTIFYING, RECORDING and COMMUNICATING economic events of an organization to interested users.

- Identifying – This involves selecting economic events that are relevant to a particular business transaction.

- Recording – This involves keeping a chronological diary of events that are measured in pesos.

- Communicating – Occurs through the preparation and distribution of financial and other accounting reports.

It’s way more than counting money. Accounting is not just one thing; in a corporation or business, there are many layers or types of accounting. In very large companies and corporations, each of those layers might have its own department, staffed by many accountants all taking care of one small part. In small businesses, it might all be the job of one (very tired) accountant.One of the most important jobs of an accountant is developing reports for the management and executives. This is where modern accounting technology really shines; computers can do analysis in seconds that once took highly skilled accountants weeks of research and crunching. Reports of any kind can be produced with the push of a button and a quick snap-shot of the transactions and cash flow are revealed. Well let’s cut it off, just focus at Financial Statement.

Speaking of the “Business” there will be a steps to make a financial statements. Look at the figure below. To make your make your company better, you will make a Financial Statement or Financial Reports to see how it works.

- Step 1: Analysis of Business transaction – It is to define, identify, and understand the relationship between asset, liability, and owner’s equity accounts. 2-3. Analyze the effects of business transactions on a firm’s assets, liabilities, and owner’s equity and record these effects in accounting equation form.

This analysis is need to be prepared before you begin to do your financial statement.

These are the three Elements of Accounts:

Assets – Economic resources owned by the business with the following features: It is a resource obtained from a past event, the enterprise has to control over it, future economic benefits will be received from its use. These are the Accounts of Assets:

- Cash

- Accounts Receivable

- Notes Receivable

- Merchandise

- Supplies

- Land

- Furniture and Fixtures

- Equipment

- Building

- Machinery

Liabilities – Simply defined as an obligation to do or pay with the following features: There is a present obligation, which arose from the past event and, settlement is expected to be made in the form of an outflow of resources. Accounts for Liabilities:

- Accounts Payable

- Notes Payable

- Loans Payable

- Mortgage Payable

- Unearned Revenue

Owner’s Equity – Residual right or interest of the owner in the net entities net assets. Accounts for Owner’s Equity:

- Owner’s Capital

- Owner’s Drawing

- Step 2: Make Journal Entries – A journal entry, in accounting, is the logging of a transaction into accounting journal items. The journal entry can consist of several recordings, each of which is either a debit or a credit. The total of the debits must equal the total of the credits or the journal entry is said to be “unbalanced”.

This is an example of How to record a Journal Entries.

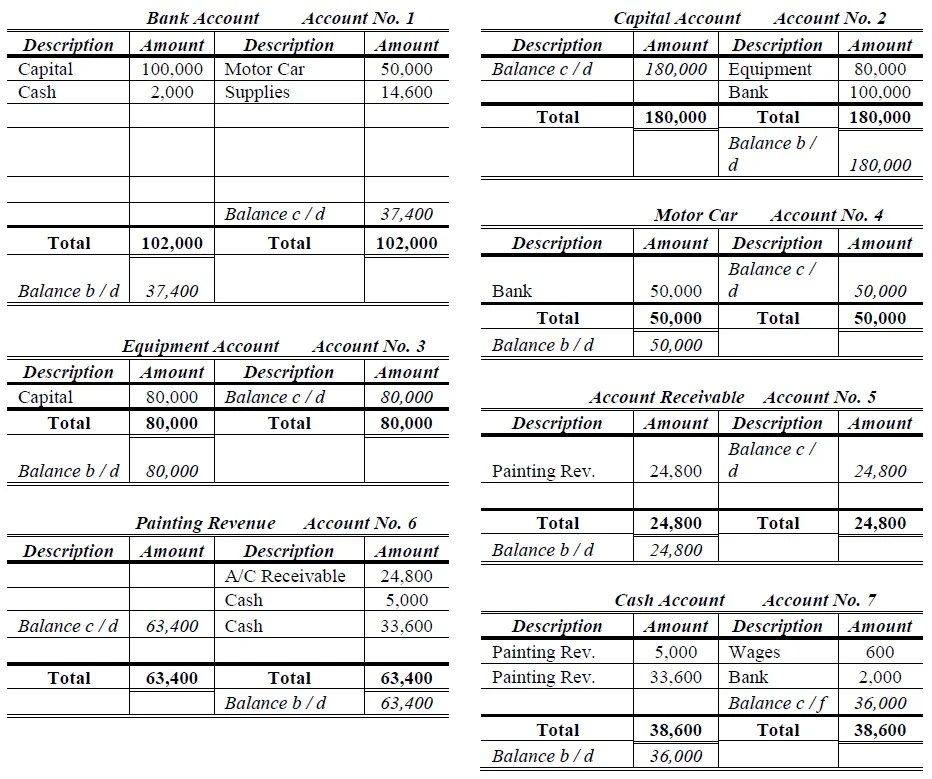

- Step 3: Post to Ledger Accounts – A general ledger account is an account or record used to sort and store balance sheet and income statement transactions. Examples of general ledger accounts include the asset accounts such as Cash, Accounts Receivable, Inventory, Investments,Land, and Equipment.

Posting General Ledger

It is the group or the grouping of all accounts used in the prepararion of financial statement.

- Step 4: Prepare Trial Balance – A statement of all debits and credits in a double-entry account book, with any disagreement indicating an error.

- Prepare a worksheet with three columns. …

- Fill in all the account titles and record their balances in the appropriate debit or credit columns.

- Total the debit and credit columns.

- Compare the column totals.

- Step 5: Make Adjusting Entries – Are accounting journal entries that convert a company’s accounting records to the accrual basis of accounting. An adjusting journal entry is typically made just prior to issuing a company’s financial statements.

- Step 6: Adjusted Trial Balance – An adjusted trial balance is prepared after adjusting entries are made and posted to the ledger. This is the second trial balance prepared in the accounting cycle. Its purpose is to test the equality between debits and credits after adjusting entries are entered into the books of the company.

This Information is involve the Step 7 & 8.

- Step 7: Prepare Financial Statements – Preparing general-purpose financial statements; including the balance sheet, income statement,statement of retained earnings, and statement of cash flows; is the most important step in the accounting cycle because it represents the purpose of financial accounting.

- Step 8: Close Accounts – Select ‘Close account‘ from the ‘Account services’ menu. You will then see a page detailing the balance of your account. Select which of your existing Halifax accounts you wish to transfer the money to. You will also be asked to select your reason for closing the account.

- Step 9: Post Costing Trial Balance – A post-closing trial balance is a trial balance which is prepared after all of the temporary accounts in the general ledger have been closed.

Costing Trial Balance.

At the end of every accounting period, accounting reports are prepared by the accountant to inform the owner/s, management and other interested parties regarding the status of the business, particularly the results of its operations and its financial condition. these reports are called financial statements. These statements serve as the means of communication between the business and all interested parties.

The accounting period is the period at the edn of which financial statements are prepared. The period generally covers one year becauseits jibes with the payment of income tax which is annually.

The annull accounting period can be classified into:

- Calendar Year – A 12-month which ends December 31.

- Fiscal Year – Any 12-month period this does not end December 31.

- Natural Business Year – A 12-month period which ends in the month business activities are at their lowest.

The financial statements to be prepared as mentioned earliesr in chapter one include the following (listed in the order they will be prepared):

Income Statement – This statement summarizes the different revenues and expenses of the business to arrive at the net income. The statement will show whether the business makes a profit or incurs a loss. It shows the results of the operations of the business. All the accounts appearing in this statement are called nominal accounts in the sense that they are merely temporary accounts and are not carried forward from period to period.

In Income Statement Revenue’s should be total and expenses will be less in total income to get the Net Income.

Statement Of changes in Owner’s Equity – This statement will show that changes (increase or decrease) in the owner’s equity. Owner’s equity will increase as a result of additional investment of the owner and the net income earned by the business. Conversely, the owner’s equity will decrease as a result of the regular withdrawal (drawing) of the owner or net loss incurred. These statements merely supplement the Balance Sheet.

This statement shown the investing and withdrawn by the owner, where the capital and Additional Investment will be add and less the Drawing.

Balance Sheet or Statement of Financial Position – This statement will show assets, liabilities, and owner’s equity of the business as of a given date (the end of the accounting period). It shows the financial condition of the business. All accounts appearing in this statement are called real accounts in the sense that they are more or less permanent in nature and their balances are carried forward from period to period.

In this statement, the Assets and Liabilities, Owner’s Equity will be equal or balance.

Cash Flow Statement – This statement will show the sources and use of cash. It shows the net cash flow (inflow less outflow) from the three activities of the business; operating, investing, and financial activities.

This statement shown what are the Inflow and Outflow of the cash activities from the business.

All business are required by Bureau of Internal Revenue (BIR) to submit quarterly and annually, the above financial statements for income tax purposes.

If we talk about the relationship of Accounting in business, Accounting is the language of the business. All the questions we have in business have an answer in accounting. Your Financial statement or Financial report will ended at Cash flows.

References:

- http://www.lawsonsca.com/

- https://www.pinterest.ph/pin/30117891234654281/

- http://www.cerritos.edu/dljohnson/_includes/docs/Chapter_1_pdf_file.pdf

- https://www.playaccounting.com/explanation/ta-exp/analysis-of-transaction/

- https://en.wikipedia.org/wiki/Journal_entry

- https://www.accountingcoach.com/bonds-payable/explanation/3

- https://www.accountingcoach.com/blog/what-is-a-general-ledger-account

- https://www.google.com.ph/search?q=Dictionary

- http://content.moneyinstructor.com/1499/trialbalance.html

- https://www.dummies.com/business/…/preparing-a-trial-balance-for-your-business/

- https://www.accountingcoach.com/adjusting-entries/explanation

- https://www.accountingverse.com/accounting-basics/adjusted-trial-balance.html

- https://www.myaccountingcourse.com/accounting-cycle/financial-statement-preparation

- http://www.halifax.co.uk/aboutonline/…accounts/closing-accounts/close-a-savings-account/

- https://www.accountingcoach.com/blog/post-closing-trial-balance

- https://study.com/academy/lesson/steps-in-the-process-cost-flow.html

- https://www.accountingformanagement.org/income-statement/

- https://businesstips.ph/how-to-make-a-statement-of-changes-in-owners-equity/

- https://www.accountingcoach.com/balance-sheet/explanation/4

- https://www.accountingcoach.com/financial-ratios/explanation/4

- https://www.accounting-degree.org/what-is-accounting/

The information that are not listed in reference can be found in book accountancy.

That’s very educational !!!

LikeLike